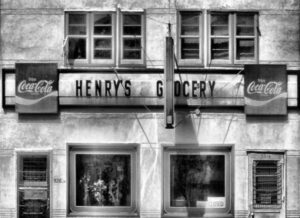

Welcome to Small-Mart: Is a Return to the Mom ‘n’ Pop Grocery Store the Future?

A recent report by the Hartman Group finds that large-scale grocery store tactics, which have been our shopping norm for the last half-century, have “stalled.” Does this mean the big box stores are on their way out?

“In a nutshell,” reports Food Navigator, “the hi-lo, be-all-things-to-all-people strategy that made supermarket chains such a success 40-50 years ago is no longer working.”

It’s not?

That kind of comes as a surprise as Wal-Mart and the like continue to dominate the grocery-store-with-so-much-more market. But for the most part, these supermarket grocery store chains don’t make their money off of your cart-full of Pop-Tarts. The big bucks come in the form of slotting fees Kellogg’s pays to make those deliciously terrible-for-you toaster pastries mysteriously jump off the shelf and into your cart, along with the soda and chips you swore you weren’t going to buy.

Forty percent of grocery store revenue is still being generated by “shrinking giants”—categories that include frozen pizza, canned soup, soda, candy and cereal. Big name brands like Kellogg’s, Coca-Cola and Frito-Lay pay the stores to guarantee aisle space, premium endcaps and over-facings of products that Americans are beginning to realize they shouldn’t be consuming, no matter how cheap they are, how many new flavors they’ve yet to try, or just how clever the brand marketing is. And according to the Hartman Group’s report, these declining processed food categories could soon be replaced by “better SKU [stock-keeping unit] management and distribution technologies,” which could do away with the gargantuan Pepsi/Coke/Dr Pepper presence in the soda aisle. These new technologies “could allow for smaller shelf sets that are equally (if not more) efficient revenue generators.”

But while these grocery store chains still lure customers into the brightly lit massive maze of industrial food, many consumers are reverting back to small retailers. Even some of the large chains are opening stores with smaller footprints. “There are lots of reasons to think small when it comes to grocery stores,” California Health reports. “Most neighborhoods can accommodate a 10,000-square-foot site.”

A return to shopping the “neighborhood” community is a trend that may have began with the boom in farmers markets in recent years; but it’s also creeping into grocery sales, according to California Health. “In spite of a national trend toward larger supermarkets, small-scale markets are now on the rise, coming back to the city to tap unmet demand.”

While Wal-Mart, and even Whole Foods for that matter, don’t seem to be going away anytime soon, finding a locally owned and operated alternative may be easier than you think. Buying clubs and food co-ops can often compete on prices with the giant supermarkets on commodity items. They don’t typically work on slotting fees, but they’ll buy in bulk or work on a smaller margin to get your business for those staples. And there are just as many reasons to support your local grocery store as there are to support the vendors at your farmers market: Often, the local grocery store will feature a variety of local, artisan-crafted foods; they’ll select the best-selling national brands. Because they don’t have to acquiesce to vendor demands (per slotting arrangements), they have more freedom to focus on what their customers really want. A novel concept. And, it seems, customers—not industrial food brands—might just be the most valuable commodity after all.

Keep in touch with Jill on Twitter @jillettinger

Image: striatic